Some people believe there’s a group of homeowners who may be reluctant to sell their houses because they don’t want to lose the historically low mortgage rate they have on their current home. You may even have the same hesitation if you’re thinking about selling your house.

Data shows 51% of homeowners have a mortgage rate under 4% as of April this year. And while it’s true mortgage rates are higher than that right now, there are other non-financial factors to consider when it comes to making a move. In other words, your mortgage rate is important, but you may have other things going on in your life that make a move essential, regardless of where rates are today. As Jessica Lautz, Vice President of Demographics and Behavioral Insights at the National Association of Realtors (NAR), explains:

“Home sellers have historically moved when something in their lives changed – a new baby, a marriage, a divorce or a new job. . . .”

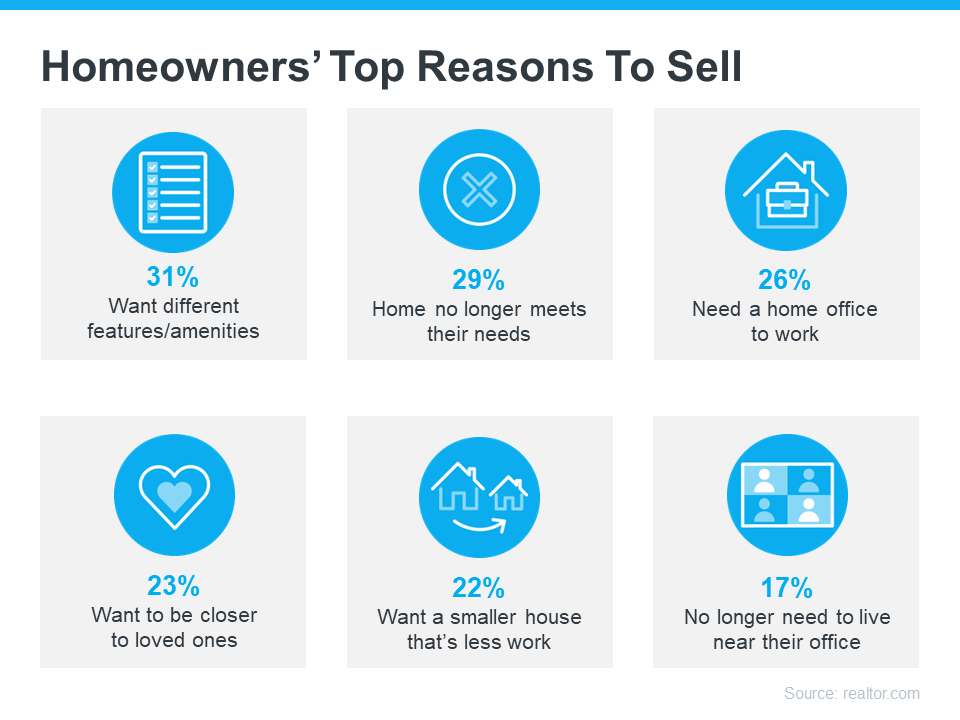

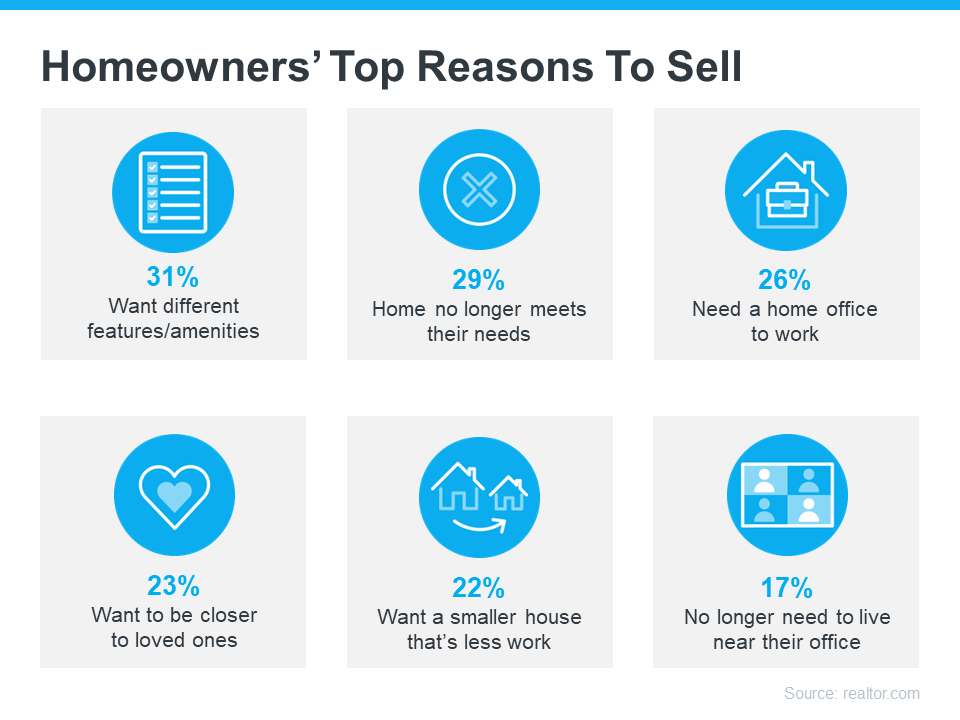

So, if you’re thinking about selling your house, it may help to explore the other reasons homeowners are choosing to make a move today. The 2022 Summer Sellers Survey by realtor.com asked recent home sellers why they decided to sell. The visual below breaks down how those homeowners responded:

As the visual shows, an appetite for different features or the fact that their current home could no longer meet their needs topped the list for recent sellers. Additionally, remote work and whether or not they need a home office or are tied to a specific physical office location also factored in, as did the desire to live close to their loved ones.

The realtor.com survey summarizes the findings like this:

“The primary reason homeowners decided to sell in the last year was the realization that, after so much time spent at home, they wanted different features and amenities, such as walkability, outdoor space, pool, etc. . . . ”

If you, like the homeowners they surveyed, find yourself wanting features, space, or amenities your current home just can’t provide, it may be time to consider listing your house for sale.

Even with today’s mortgage rates, your lifestyle needs may be enough to motivate you to make a change. The best way to find out what’s right for you is to partner with a trusted real estate professional who can provide expert guidance and advice throughout the process. They can help walk you through your options, so you can make a confident decision based on what matters most to you and your loved ones.

Bottom Line

While the financial reasons for moving are important, there’s often far more to consider. Non-financial reasons can also be a significant motivating factor. If you need help weighing the pros and cons of selling your house, let’s connect today.

Content previously posted on Keeping Current Matters

![Fall Home Selling Checklist [INFOGRAPHIC] | Simplifying The Market](https://files.simplifyingthemarket.com/wp-content/uploads/2022/09/20144848/20220923-KCM-Share-549x300.png)

![Fall Home Selling Checklist [INFOGRAPHIC] | Simplifying The Market](https://files.simplifyingthemarket.com/wp-content/uploads/2022/09/20144842/20220923-MEM.png)

![A Crucial First Step: Mortgage Pre-Approval [INFOGRAPHIC] | Simplifying The Market](https://files.simplifyingthemarket.com/wp-content/uploads/2022/09/15085140/20220916-KCM-Share-549x300.png)

![A Crucial First Step: Mortgage Pre-Approval [INFOGRAPHIC] | Simplifying The Market](https://files.simplifyingthemarket.com/wp-content/uploads/2022/09/15085055/20220916-MEM.png)