- Home

- Partners

- Purchase

- Refinance

- Mortgage Programs

- | Home Purchase Qualifier |

- | Mortgage Rate Quote |

- Apply Now

- 1 Year Tax Return Mortgages

- 3.5% Down Payment Program

- Asset Depletion Mortgages

- Bank Statement Mortgages

- Bridge Loans

- Condo Mortgages

- Condotel Mortgages

- Conforming Mortgages

- Co-op Mortgages

- Construction Mortgages

- Delayed Financing Mortgages

- DSCR Mortgages

- FHA Mortgages

- First-Time Home Buyer Programs

- Foreign National Mortgages

- Investment Home Mortgages

- Jumbo Mortgages

- Manufactured Home Mortgages

- Non-Warrantable Condo Mortgages

- Portfolio Mortgages

- Second Home Mortgages

- Self-Employed Mortgages

- Short Term Rental Mortgages

- USDA Mortgages

- Veterans Mortgage

- Today's Mortgage Rates

- | Home Purchase Qualifier |

- | Mortgage Rate Quote |

- 1 Year Tax Return Rates

- Asset Depletion Rates

- Bank Statement Rates

- Bridge Loans Rates

- Condotel Rates

- Condo Rates

- Conforming Rates

- Co-op Mortgage Rates

- Delayed Financing Mortgage Rates

- DSCR Mortgage Rates

- FHA Rates

- First-Time Home Buyer Rates

- Foreign National Rates

- Investment Property Rates

- Jumbo Rates

- New Construction Rates

- Non-Warrantable Condo Rates

- Renovation Rates

- Second Home Rates

- Short Term Rental Loan Rates

- Veterans Rates

Mortgage Credit Scoring

Staying on top of your credit scores is critical, especially when you are planning on a home. FICO® scores are the credit scores most lenders use to determine your credit risk and the interest rate you will be charged.

Mortgage Credit Scoring

There are numerous credit scoring models in use, but the two most prominent and widely recognized are the FICO score and the VantageScore. These models have various versions and iterations designed for specific purposes, such as mortgage lending, credit card approvals, or auto loans. Additionally, different industries and lenders may use their proprietary scoring models for evaluating credit applicants. As a result, the specific number of credit scoring models can vary, and new models may be developed over time to meet evolving credit assessment needs.

When a consumer sees their credit score from a credit card or checks their annual credit report, they are seeing a basic scoring model. Different scoring models will showing different credit scores.

Mortgage credit scoring is a crucial part of the mortgage application process. Lenders use credit scores to assess an applicant’s creditworthiness when considering whether to approve a mortgage application and determining the interest rate and terms of the loan. Here’s what you need to know about mortgage credit scoring:

- Credit Scores: Credit scores are numerical representations of your creditworthiness based on your credit history and financial behavior. The most commonly used credit scores for mortgage lending are FICO scores and VantageScore. FICO scores are widely preferred in the mortgage industry.

- Credit Bureaus: Credit bureaus (Equifax, Experian, and TransUnion) compile your credit history and calculate your credit scores based on the information they receive from lenders and creditors.

- Factors Affecting Mortgage Credit Scores: Payment History: Your history of on-time payments and any late payments or defaults.

- Credit Utilization: The ratio of your credit card balances to your credit limits.

- Length of Credit History: How long you’ve had credit accounts open. Types of Credit: The mix of credit accounts, including credit cards, loans, and mortgages. New Credit Inquiries: Recent applications for credit can impact your score.

- Minimum Credit Score Requirements: Different lenders may have varying minimum credit score requirements for mortgage applicants. A higher credit score usually increases your chances of getting approved and securing better terms.

- Interest Rates and Terms: Your credit score can significantly influence the interest rate you’re offered. Higher scores often result in lower interest rates and better loan terms. A lower credit score might still allow you to qualify for a mortgage, but it may come with a higher interest rate, which can cost you more over the life of the loan.

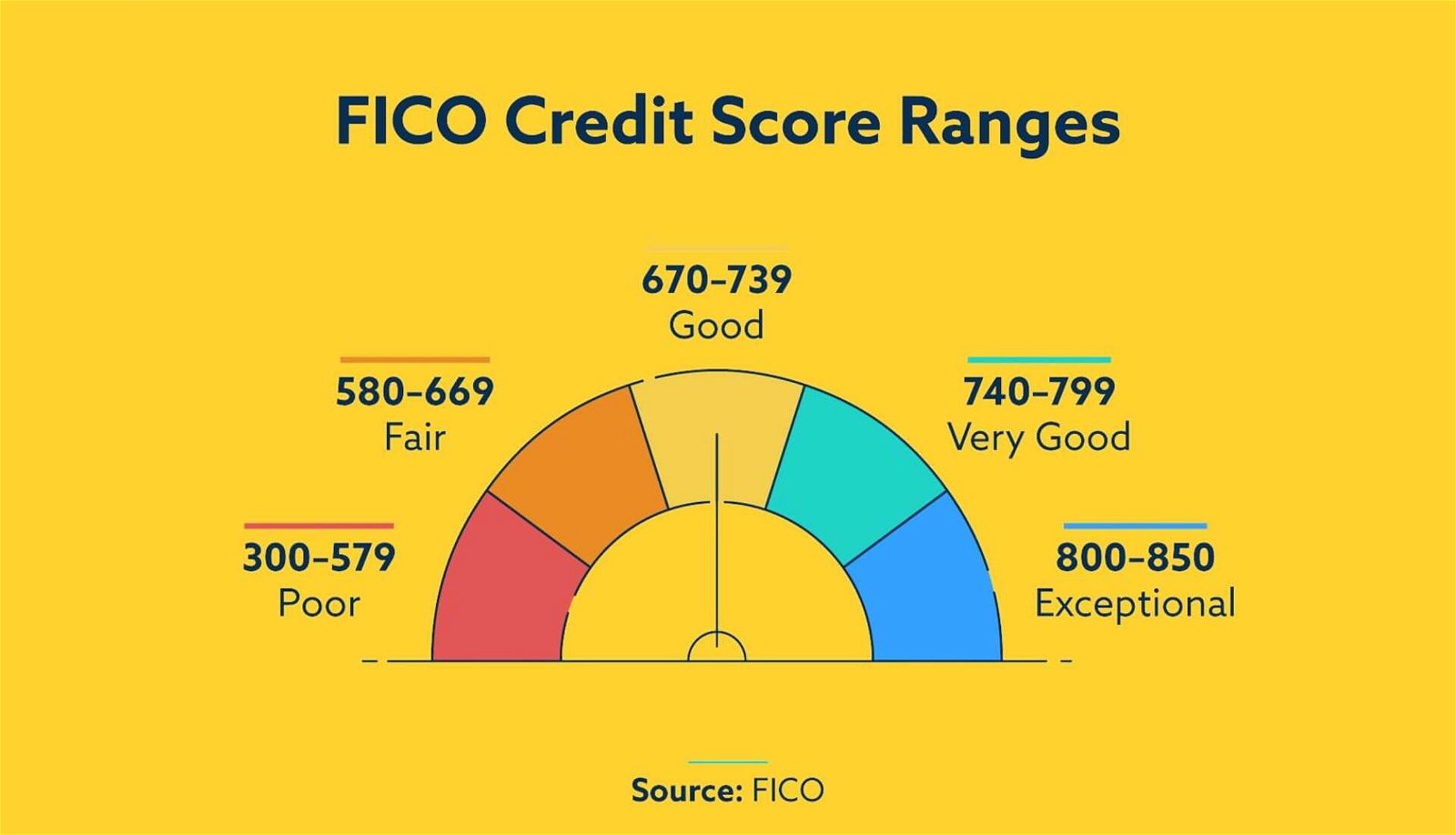

- Credit Score Ranges: FICO scores generally range from 300 to 850, with higher scores indicating better creditworthiness. Mortgage lenders often use specific score ranges to categorize applicants, such as excellent (760 and above), good (700-759), fair (620-699), and poor (below 620). Credit Score Improvement: If your credit score is lower than you’d like, you can take steps to improve it over time. These include paying bills on time, reducing credit card balances, and avoiding new credit inquiries.

- Credit Reports: Regularly review your credit reports from all three major credit bureaus to check for errors or discrepancies. You can request free credit reports annually through AnnualCreditReport.com. Prequalification and Preapproval: Before house hunting, it’s a good idea to get prequalified or preapproved for a mortgage. Prequalification is a basic assessment of your financial situation, while preapproval involves a more detailed credit check.

- Credit Score Monitoring: There are various credit monitoring services and apps that can help you keep track of your credit score and receive alerts about changes in your credit report.

Understanding your credit score and taking steps to improve it can significantly impact your ability to secure a mortgage with favorable terms. It’s essential to maintain a good credit history to increase your chances of being approved for a mortgage and obtaining competitive interest rates.