- Home

- Partners

- Purchase

- Refinance

- Mortgage Programs

- | Home Purchase Qualifier |

- | Mortgage Rate Quote |

- Apply Now

- 1 Year Tax Return Mortgages

- 3.5% Down Payment Program

- Asset Depletion Mortgages

- Bank Statement Mortgages

- Bridge Loans

- Condo Mortgages

- Condotel Mortgages

- Conforming Mortgages

- Co-op Mortgages

- Construction Mortgages

- Delayed Financing Mortgages

- DSCR Mortgages

- FHA Mortgages

- First-Time Home Buyer Programs

- Foreign National Mortgages

- Investment Home Mortgages

- Jumbo Mortgages

- Manufactured Home Mortgages

- Non-Warrantable Condo Mortgages

- Portfolio Mortgages

- Second Home Mortgages

- Self-Employed Mortgages

- Short Term Rental Mortgages

- USDA Mortgages

- Veterans Mortgage

- Today's Mortgage Rates

- | Home Purchase Qualifier |

- | Mortgage Rate Quote |

- 1 Year Tax Return Rates

- Asset Depletion Rates

- Bank Statement Rates

- Bridge Loans Rates

- Condotel Rates

- Condo Rates

- Conforming Rates

- Co-op Mortgage Rates

- Delayed Financing Mortgage Rates

- DSCR Mortgage Rates

- FHA Rates

- First-Time Home Buyer Rates

- Foreign National Rates

- Investment Property Rates

- Jumbo Rates

- New Construction Rates

- Non-Warrantable Condo Rates

- Renovation Rates

- Second Home Rates

- Short Term Rental Loan Rates

- Veterans Rates

Financial Advisor Partnership Benefits

Ensure a seamless experience for your clients and recommend Fidelity Home Group! We give top priority to your clients, emphasizing transparency and efficiency in our interactions. This commitment has led to us receiving some of the highest customer satisfaction ratings in the industry.

Fidelity Home Group’s Financial Advisor Partnership Benefits

At Fidelity Home Group, true partnerships begin with communication!

Fidelity Home Group is dedicated to simplifying the home buying process, both for you and your clients. We provide a wide range of mortgage products tailored to various buyer profiles, including options like Bank Statements, DSCR, Non-Warrantable Condo, Condotel, Coop, Second Home and several Investment Property options. Our expertise is working with you and your client to identify the financial goal intended, and ensure a timely closing.

We strive to gain your confidence and

support the growth of your business!

Financial Advisor Partnership Benefits Include:

Communication

We over communicate plain and simple.

With over two decades working with real estate agents and referral partners, everyone communicates differently. Some real estate partners like to be cc’d on every email and updated every 48 – 72 hours and some only want to be updated once a week. We always to keep you in the loop with the mortgage process.

We tailor our communication style to yours to ensure we have an open communication in our partnership!

- We track every referral you send and let you know exactly where we are with them in the buying process.

- Know which buyers are pre-approved, actively searching and requesting scenarios, or who has gone cold.

Client Hand Holding

We invest the time to inform and guide your clients about the mortgage programs and the process that Fidelity Home Group can and will provide for them.

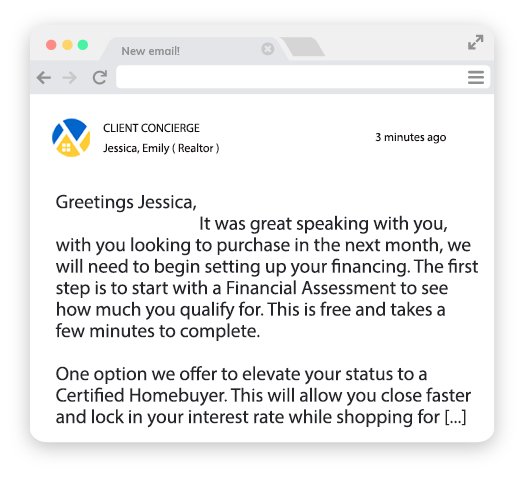

After our initial phone conversation with your client:

- We send a follow up intro email that walks the client through the Refinance or Home Buying process and timelines.

- We discuss scenarios on down payment scenarios for purchases or cash out options for refinances plus the different mortgage programs to give your client options.

- We will send those mortgage programs for your client to review all the detailed options. We will copy you on every email so you will immediately know we spoke with your client and what was discussed.

Client Referral Summaries

Summaries for every referral you send our way.

This is one of the things our referral partners love the most about Fidelity Home Group.

- After every conversation, we send a new referral summary to our Team that is automatically saved in our CRM under the borrower’s name.

- All necessary info is noted into our system up front, so the client is not ever asked the same questions or duplicate documents twice.

- Most importantly, we copy you, our referral partner, with our referral summary so you can again see what was discussed and how viable your client is as a buyer.

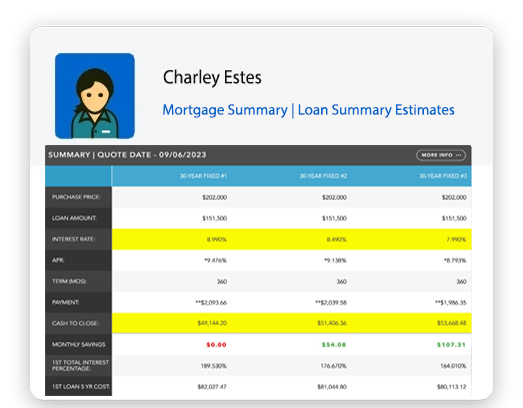

Scenarios for Your Clients

We will run any and all scenarios for your clients whenever they ask.

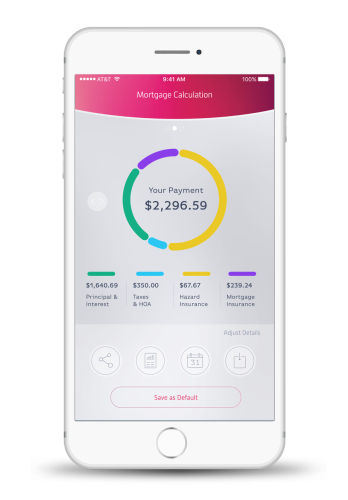

- Fidelity Home Group sends detailed payment and closing cost scenarios to every buyer.

- We details the monthly differences, savings over 60 months, interest paid overtime with graphs to compare options.

- We always copy you, the referring agent, so you can see the price ranges and payments getting discussed.

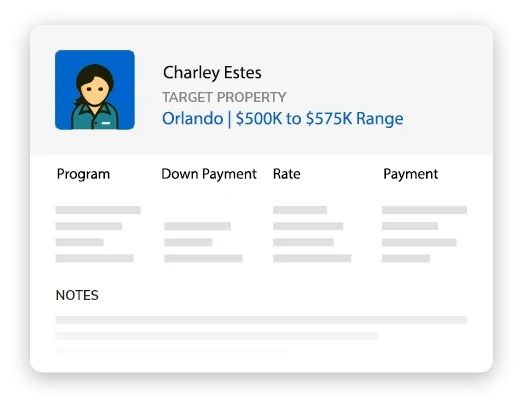

Detailed Property Reports

Property Reports with Mortgage Program options

Our Property reports will allow your clients to see what mortgage are available with down payment, rate and closing cost options with specific details on the property they are inquiring on.

The Property Report includes:

- Property Photos

- Property description

- Area report (distance to gas, ATMs, grocery stores, entertainment, etc.)

School report (school names, ratings, and distances) - Outdoor report (local parks, trails, and golf courses)

- Neighborhood eats report [ types of cuisine, 5 star ratings, average pricing, and categories]

Investment Property Data Reports

Rental Property Reports for short-term and long-term properties

Our short term rental reports access Vrbo and Airbnb data from over 10 million properties across 120,000 global markets.

Long term rental data acquires rent comp data by closest addresses and detailed property specifications. Our Report shows detailed list of up-to-date rent comps on a map for easy viewing.

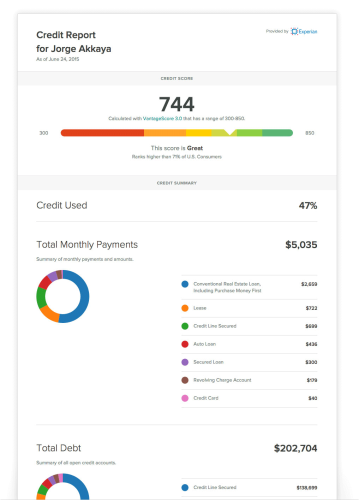

We Offer Your Clients a Soft Pull

Have a client that is not ready to get the Mortgage Process started? Fidelity Home Group offers a free soft pull for mortgage pre-qualification. This is a great starting point in the Home Buying Process! If your client is hesitant about getting a mortgage pre-approval, a mortgage soft-pull is the perfect way to get an idea of their financial situation.

Best of all, It won’t hurt their credit – Checking their credit profile with a soft pull doesn’t impact their credit. In fact, checking it can help your client figure out key areas to work on to build their score for when they are ready for a pre-approval.

Partnership has it’s Privileges

Start the process as an Financial Advisor Partner to access our exclusive beenfits.