What You Really Need To Know About Home Prices

According to recent data from Fannie Mae, almost 1 in 4 people still think home prices are going to come down. If you’re one of the people worried about that, here’s what you need to know.

A lot of that fear is probably coming from what you’re hearing in the media or reading online. But here’s the thing to remember. Negative news sells. That means, you may not be getting the full picture. You may only be getting the clickbait version. As Jay Thompson, a Real Estate Industry Consultant, explains:

“Housing market headlines are everywhere. Many are quite sensational, ending with exclamation points or predicting impending doom for the industry. Clickbait, the sensationalizing of headlines and content, has been an issue since the dawn of the internet, and housing news is not immune to it.”

Here’s a look at the data to set the record straight.

Home Prices Rose the Majority of the Past Year

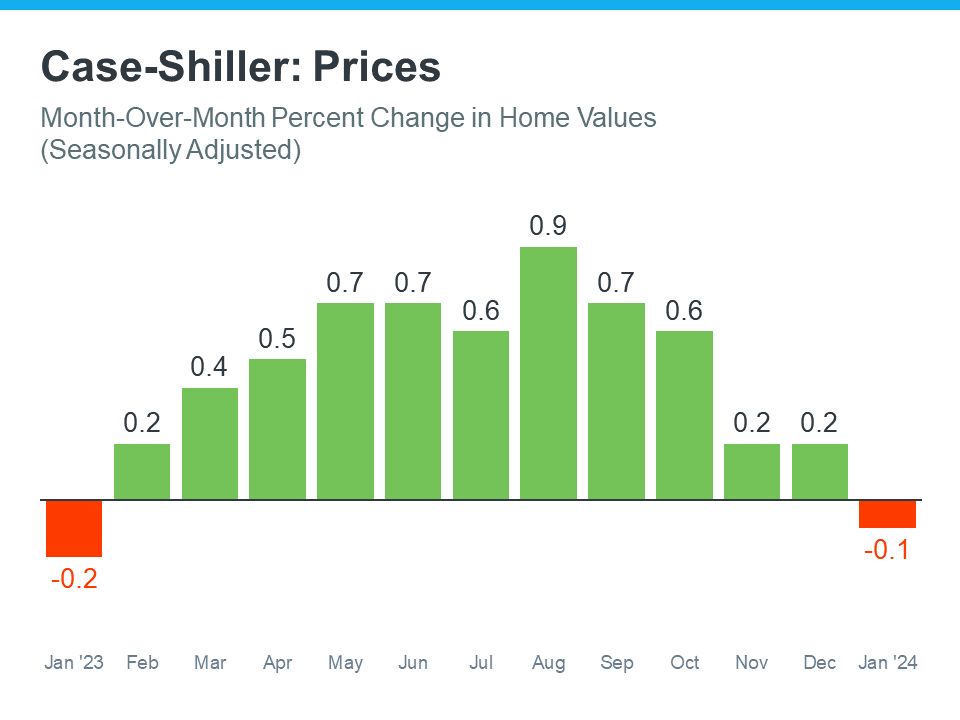

Case-Shiller releases a report each month on the percent of monthly home price changes. If you look at their data from January 2023 through the latest numbers available, here’s what you’d see:

What do you notice when you look at this graph? It depends on what color you’re more drawn to. If you look at the green, you’ll see home prices rose for the majority of the past year.

But, if you’re drawn to the red, you may only focus on the two slight declines. This is what a lot of media coverage does. Since negative news sells, drawing attention to these slight dips happens often. But that loses sight of the bigger picture.

Here’s what this data really says. There’s a lot more green in that graph than red. And even for the two red bars, they’re so slight, they’re practically flat. If you look at the year as a whole, home prices still rose overall.

It’s perfectly normal in the housing market for home price growth to slow down in the winter. That’s because fewer people move during the holidays and at the start of the year, so there’s not as much upward pressure on home prices during that time. That’s why, even the green bars toward the end of the year show smaller price gains.

The overarching story is that prices went up last year, not down.

To sum all that up, the source for that data in the graph above, Case Shiller, explains it like this:

“Month-over-month numbers were relatively flat, . . . However, the annual growth was more significant for both indices, rising 7.4 percent and 6.6 percent, respectively.”

If one of the expert organizations tracking home price trends says the very slight dips are nothing to worry about, why be concerned? Even Case-Shiller is drawing your attention to how those were virtually flat and how home prices actually grew over the year.

Bottom Line

The data shows that, as a whole, home prices rose over the past year. If you have questions about what’s happening with home prices in your local area, connect with a trusted real estate professional.

#fidelityhomegroup, #floridamortgage, #floridamortgagerates, #mortgageflorida