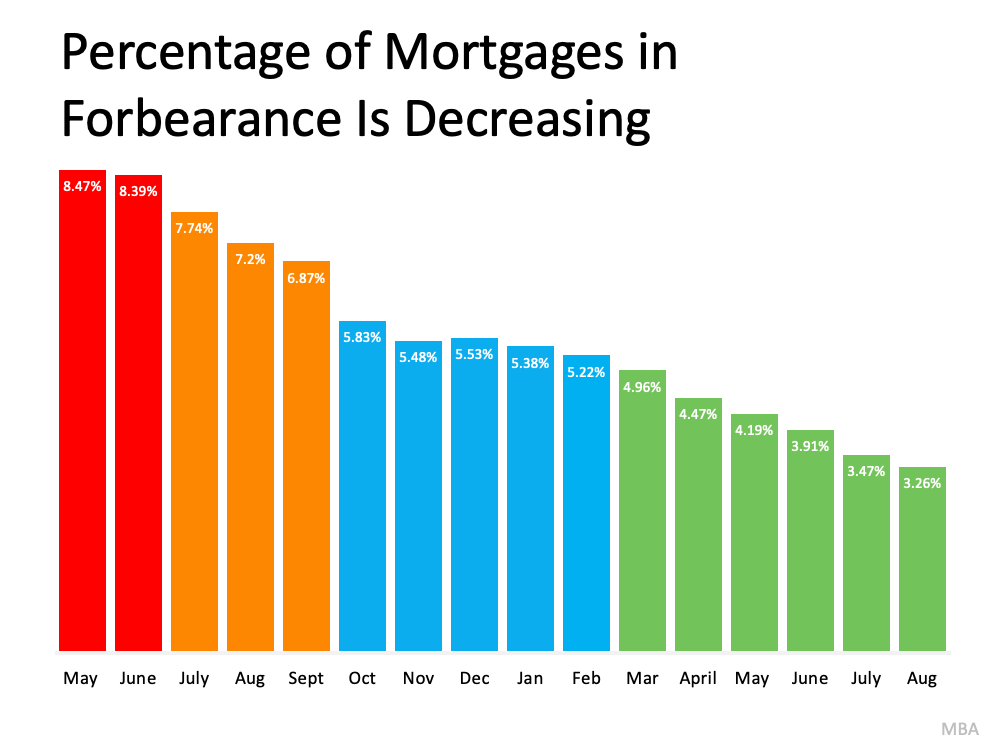

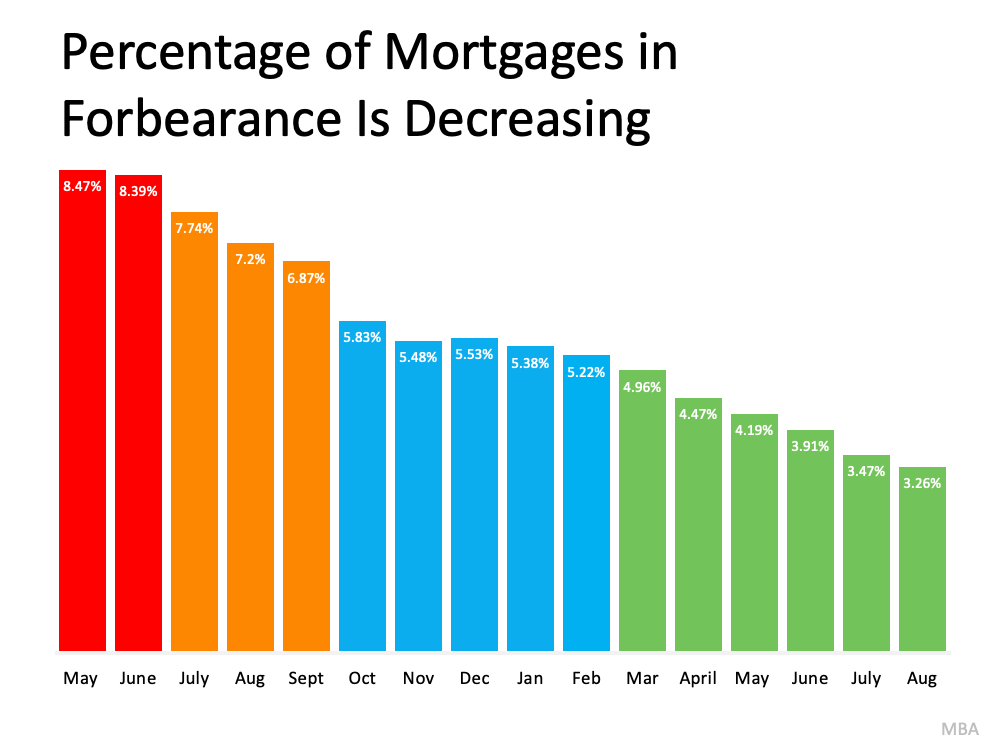

Even though experts agree there’s no chance of a large-scale foreclosure crisis, there are a number of homeowners who may be coming face-to-face with foreclosure as a possibility. And while the overall percentage of homeowners at risk is decreasing with time (see graph below), that’s little comfort to those individuals who are facing challenges today. If you haven’t taken advantage of the forbearance period, it may be time to research and understand your options. It starts with knowing what foreclosure is. Investopedia defines it like this:

If you haven’t taken advantage of the forbearance period, it may be time to research and understand your options. It starts with knowing what foreclosure is. Investopedia defines it like this:

“Foreclosure is the legal process by which a lender attempts to recover the amount owed on a defaulted loan by taking ownership of and selling the mortgaged property. Typically, default is triggered when a borrower misses a specific number of monthly payments . . .”

The good news is, there are alternatives available to help you avoid having to go through the foreclosure process, including:

- Reinstatement

- Loan modification

- Deed-in-lieu of foreclosure

- Short sale

But before you go down any of those paths, it’s worth seeing if you have enough equity in your home to sell it and protect your investment.

Understand Your Options: Sell Your House

Equity is the difference between what you owe on the home and its market value based on factors like price appreciation.

In today’s real estate market, many homeowners have far more equity in their homes than they realize. Over the last year, buyer demand has been high, but housing supply has been low. That’s led to a substantial increase in home values. When prices rise, so does the amount of equity you have in your house.

According to CoreLogic, on average, homeowners gained $33,400 in equity over the last 12 months, and the average equity on mortgaged homes is now $216,000 (see map below): So, what does that mean for you? Over the past year, chances are your home’s value and therefore your equity has risen dramatically. If you’ve been in your home for a while, the mortgage payments you’ve made over time chipped away at the balance of your loan. If your home’s current value is higher than what you still owe on your loan, you may be able to use that increase to your advantage.

So, what does that mean for you? Over the past year, chances are your home’s value and therefore your equity has risen dramatically. If you’ve been in your home for a while, the mortgage payments you’ve made over time chipped away at the balance of your loan. If your home’s current value is higher than what you still owe on your loan, you may be able to use that increase to your advantage.

Frank Martell, President and CEO of CoreLogic, elaborates on how equity can help:

“Homeowner equity has more than doubled over the past decade and become a crucial buffer for many weathering the challenges of the pandemic. These gains have become an important financial tool and boosted consumer confidence in the U.S. housing market.”

Don’t Go at It Alone – Lean on Experts for Advice

To find out what your house is worth in today’s market, work with a local real estate professional. We’ll be able to give you an estimate of what your house could sell for based on recent sales of similar homes in your area. Since home prices are still appreciating, you may be able to sell your house to avoid foreclosure.

If you find out that you have to pursue other options, your agent can help with that too. We’ll be able to connect you with other professionals in the industry, like housing counselors who can look into your unique situation and offer advice on next steps if selling isn’t the best alternative.

Bottom Line

If you’re a homeowner facing hardship, let’s connect to explore your options and see if you can sell your house to avoid foreclosure.

Content previously posted on Keeping Current Matters

Keeping Current Matters