If Housing Affordability Is About the Money, Don’t Forget This.

There are many non-financial benefits of buying your own home. However, today’s headlines seem to be focusing primarily on the financial aspects of homeownership – specifically affordability. Many articles are making the claim that it’s not affordable to buy a home in today’s market, but that isn’t the case.

Today’s buyers are spending approximately 20% of their income on their monthly mortgage payments. According to The Essential Guide to Creating a Homebuying Budget from Freddie Mac, the 20% of income that purchasers are currently paying is well within the 28% guideline suggested:

“Most lenders agree that you should spend no more than 28% of your gross monthly income on a mortgage payment (including principal, interest, taxes and insurance).”

So why is there so much talk about challenges regarding affordability?

It’s Not That Homes Are Unaffordable – It’s That They’re Less Affordable.

Since home prices are rising, it’s true that homes are less affordable than they have been since the housing crash fifteen years ago. Headlines making these claims aren’t incorrect; they just don’t tell the whole story. To paint the full picture, you have to look at how today stacks up with historical data. A closer analysis of affordability going further back in time reveals that homes today are more affordable than any time from 1975 to 2005.

Despite that, the chatter about affordability is pushing some buyers to the sidelines. They don’t feel comfortable knowing someone else got a better deal a year ago.

However, Are Homes Really Less Affordable if We Consider Equity?

In a recent post, Odeta Kushi, Deputy Chief Economist at First American, offers a different take on the financial components of housing affordability. Kushi proposes we should at least consider the impact equity build-up has on the affordability equation, stating:

“For those trying to buy a home, rapid house price appreciation can be intimidating and makes the purchase more expensive. However, once the home is purchased, appreciation helps build equity in the home, and becomes a benefit rather than a cost. When accounting for the appreciation benefit in our rent versus own analysis, it was cheaper to own in every one of the top 50 markets.”

Let’s look at an example. In the above-mentioned post, Kushi examines the rent versus buy situation in Dallas, Texas. Kushi chose Dallas because home prices there sit near the median of the top 50 markets in the nation.

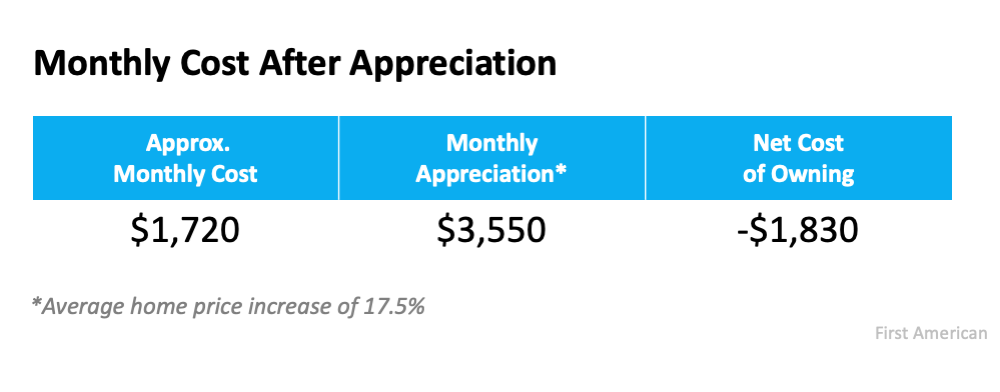

Kushi first calculates the monthly mortgage payment on a median-priced home with a 5% down payment and a mortgage rate of 3% (see chart below): Kushi then takes the monthly cost and subtracts the appreciation the home had over the previous twelve months. The average house price in Dallas increased 17.5% in the second quarter of 2021 compared to last year (this is in line with the national pace). That equates to an equity benefit of approximately $3,550 each month if the pace remains the same (see chart below):

Kushi then takes the monthly cost and subtracts the appreciation the home had over the previous twelve months. The average house price in Dallas increased 17.5% in the second quarter of 2021 compared to last year (this is in line with the national pace). That equates to an equity benefit of approximately $3,550 each month if the pace remains the same (see chart below): We can see the equity gained each month was greater than the monthly mortgage payment, resulting in a negative cost to own. The buyer could build their net worth by $1,830 each month – after paying their mortgage.

We can see the equity gained each month was greater than the monthly mortgage payment, resulting in a negative cost to own. The buyer could build their net worth by $1,830 each month – after paying their mortgage.

Kushi then compares the monthly cost of owning to the cost of renting (see chart below): When adding equity build-up into the equation, the cost of renting is $3,140 more expensive than owning. Again, the First American analysis shows that it’s less expensive to own in each of the top 50 markets in the country when including the equity component.

When adding equity build-up into the equation, the cost of renting is $3,140 more expensive than owning. Again, the First American analysis shows that it’s less expensive to own in each of the top 50 markets in the country when including the equity component.

Bottom Line

If you’re on the fence about whether to buy or rent right now, let’s connect so we can determine if the equity increase in our local market should impact your decision.

Content previously posted on Keeping Current Matters Fidelity Home Group | Home Buyer Experts | Mortgage Rates#fidelityhomegroup, #homebuyerexperts, First Time Home Buyers, For Buyers, Interest Rates, Pricing, Rent vs. Buy