When you hear the phrase home price appreciation, what does it mean to you? Through context clues alone, chances are you know it has to do with rising home prices. And as a seller, you know rising home prices are good news for your potential sale. But let’s look past the dollar signs and dive deeper into the concept. To truly understand home price appreciation, you need to know how it works and why it matters to you.

Investopedia defines appreciation like this:

“Appreciation, in general terms, is an increase in the value of an asset over time. The increase can occur for a number of reasons, including increased demand or weakening supply, or as a result of changes in inflation or interest rates. This is the opposite of depreciation, which is a decrease in value over time.”

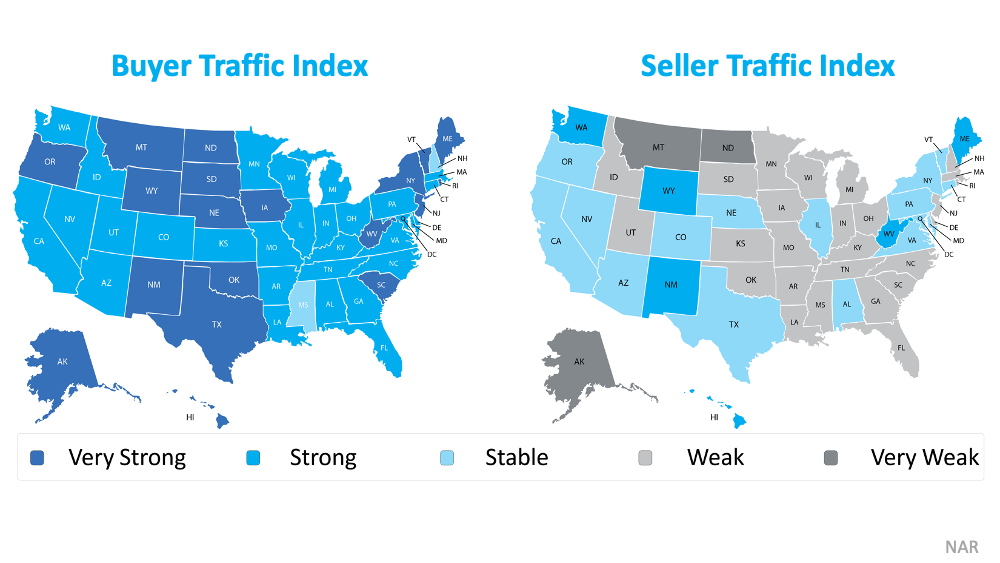

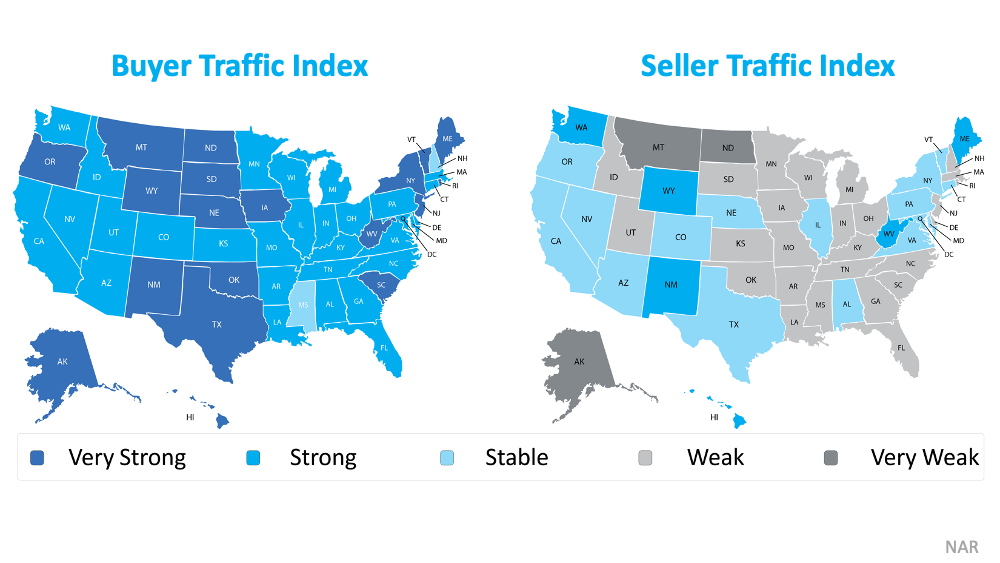

When we consider this definition and how it applies to real estate, a few words stick out: supply and demand. In today’s real estate market, we’re experiencing high buyer demand and very few sellers listing their homes for sale (see maps below): No matter the industry, anytime there’s more demand than supply, prices naturally rise. It happens because buyers are willing to pay more to secure the scarce product or service they’re looking for. That’s exactly what’s happening in today’s real estate market. Buyers are competing with one another to purchase a home, leading to bidding wars that drive prices up. For sellers, the rising prices mean that opportunity is knocking.

No matter the industry, anytime there’s more demand than supply, prices naturally rise. It happens because buyers are willing to pay more to secure the scarce product or service they’re looking for. That’s exactly what’s happening in today’s real estate market. Buyers are competing with one another to purchase a home, leading to bidding wars that drive prices up. For sellers, the rising prices mean that opportunity is knocking.

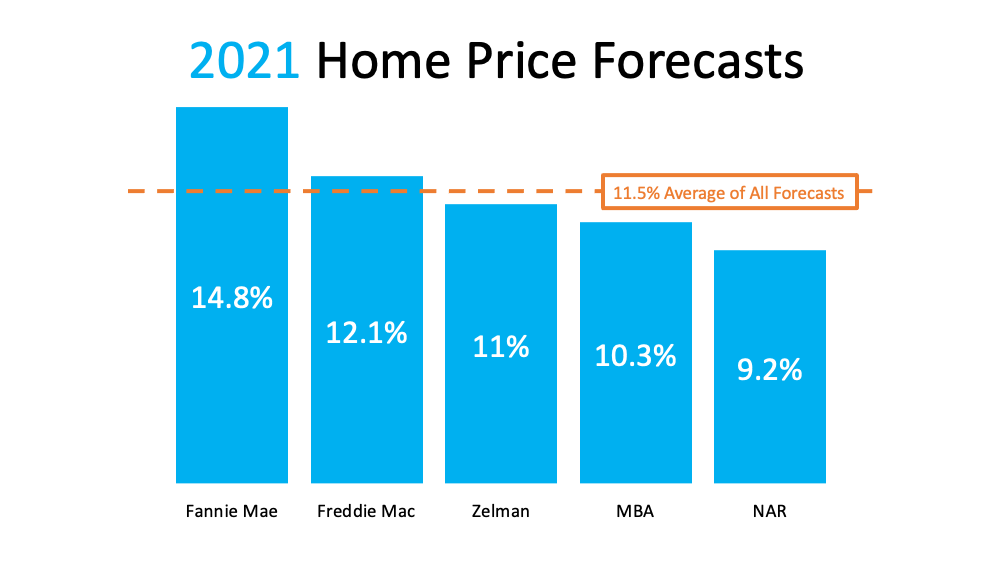

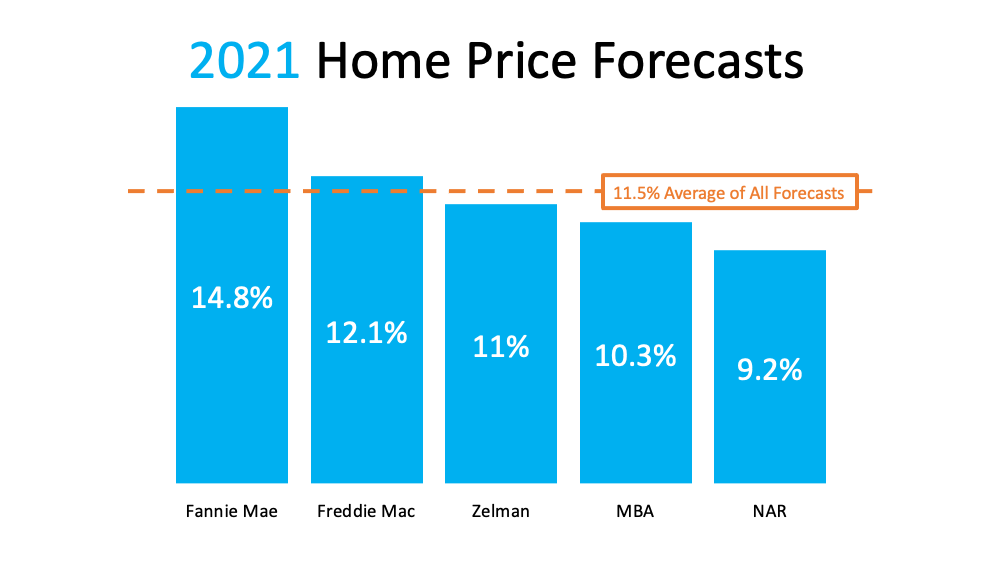

According to Quicken Loans, the national average home price appreciation rate is between 3-5% in a typical year. Today, home prices are appreciating well beyond the norm thanks to high demand. Here are the latest expert projections on the rate of home price appreciation for this year (see chart below):

Compared to the normal pace of 3-5% appreciation per year, the current average forecast of nearly 11.5% is significant.

For sellers, this means that with the current rise in prices, your house may be worth more than you realize. That price appreciation helps give your equity a boost. Equity is the difference between what you owe on the home and its market value based on factors like price appreciation. It works like this (see chart below): You can use your built-up equity to power a move into your dream home, or you can put it toward life-changing goals like funding an education or opening a business.

You can use your built-up equity to power a move into your dream home, or you can put it toward life-changing goals like funding an education or opening a business.

But don’t wait. While price appreciation is strong now, those same experts say it’ll start to appreciate at a more normalized pace next year. If you list your house sooner rather than later, you’ll be in a better position to capitalize on the higher-than-average home price appreciation we’re seeing today.

Bottom Line

If you’re thinking of selling your house, there really is no time like the present. Let’s connect so you can get an expert market analysis of your home and its potential.

Content previously posted on Keeping Current Matters

Keeping Current Matters