If you’re on the fence about whether or not you want to sell your house this year, there’s good news. Real estate professionals are highly experienced in how to sell houses safely during the pandemic. Over the last year, agents have adopted new technologies and safety measures designed to keep you safe. And experts say these practices are here to stay. As Bob Goldberg, CEO of the National Association of Realtors (NAR), puts it:

“The pandemic has confirmed to all of us in the industry that technology will continue to transform real estate.”

Below is a closer look at some of the new tools real estate professionals are using to better serve sellers.

New and Existing Technology Are Impacting the Process

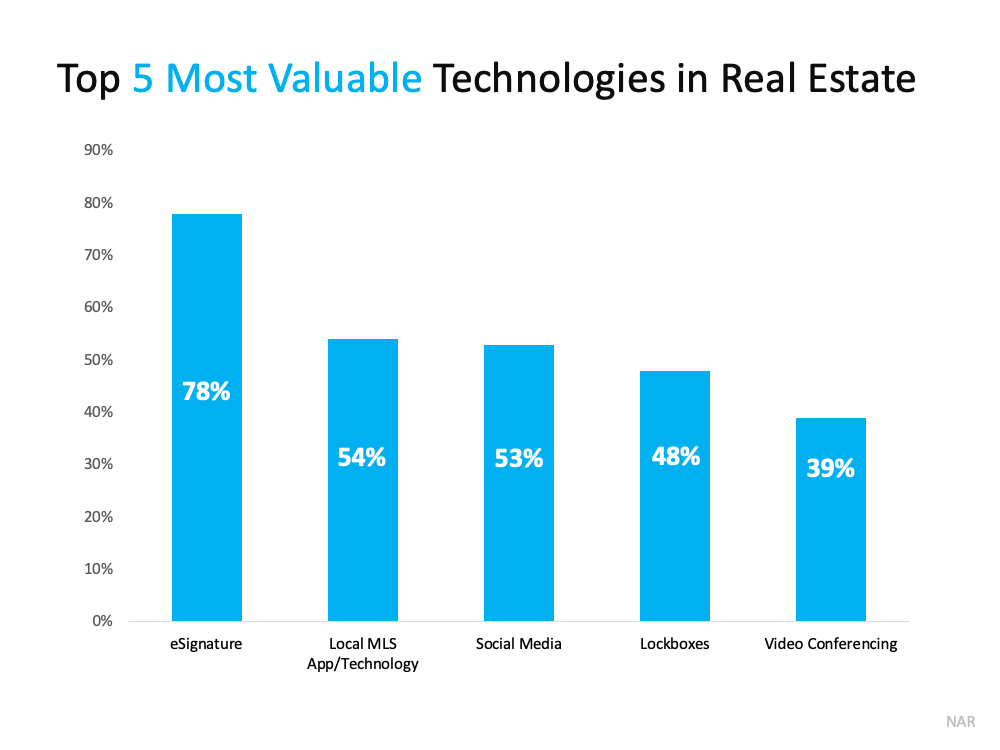

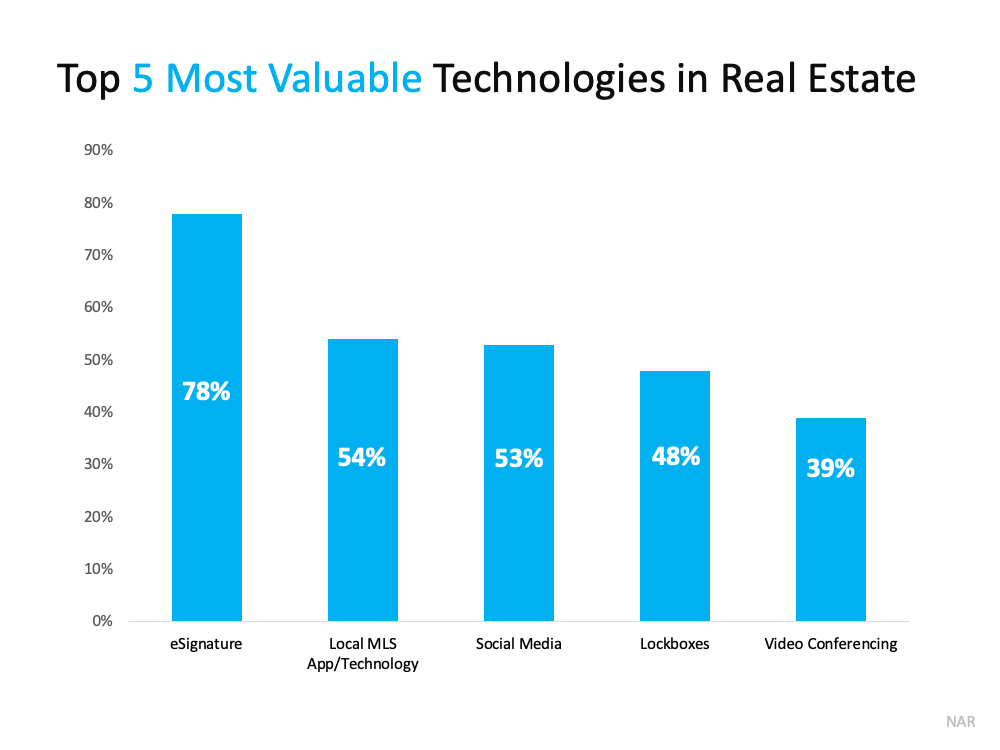

In the 2021 Realtor Technology Survey, NAR asks real estate professionals their opinions on the most valuable pieces of technology for their business over the past 12 months. The graph below highlights the top five tools those agents said are true game-changers: Tools that allow agents to serve clients at a distance and limit exposure to others, including eSignature, lockboxes, and video conferencing, became increasingly important during the last year. Those same tools are just as essential today. Restricting the number of people a seller must interact with during the process is the best way to keep all parties involved in a sale safe.

Tools that allow agents to serve clients at a distance and limit exposure to others, including eSignature, lockboxes, and video conferencing, became increasingly important during the last year. Those same tools are just as essential today. Restricting the number of people a seller must interact with during the process is the best way to keep all parties involved in a sale safe.

Trusted Advisors Stay Up to Date on Guidelines for In-Person Showings

As things change in our day-to-day lives, the guidance on how to stay safe changes as well. NAR regularly updates the resources available to real estate professionals to ensure the latest recommendations and best practices are readily available. This includes suggestions on how to continue to conduct safe in-person showings.

Agents also follow guidance from the Centers for Disease Control (CDC) to make sure homes are safe. The CDC’s advice includes information on how to clean high-touch surfaces like doorknobs, tables, and countertops so they’re disinfected for all.

This past year changed the way agents do things for the better. Real estate professionals use new technology, tools, cleaning procedures, and the latest guidance to meet your changing needs. The goal is to keep you safe and build your confidence throughout the sales process.

Bottom Line

It’s important to know that your safety is still a top priority when it comes to selling this year. Let’s connect today so you can have the best tools available to help you take advantage of today’s sellers’ market.

Content previously posted on Keeping Current Matters Fidelity Home Group | Home Buyer Experts | Mortgage Rates